Calc your business mileage

with a click

Calculate your itemized and total car mileage expenses from your calendar for expense reporting and tax deductions.

Get notified of our launch

Receive launch updates directly to your inbox.

Revolutionary

Approach

By using information you already having in your calendar, you can save yourself a lot of work and anguish.

No more…

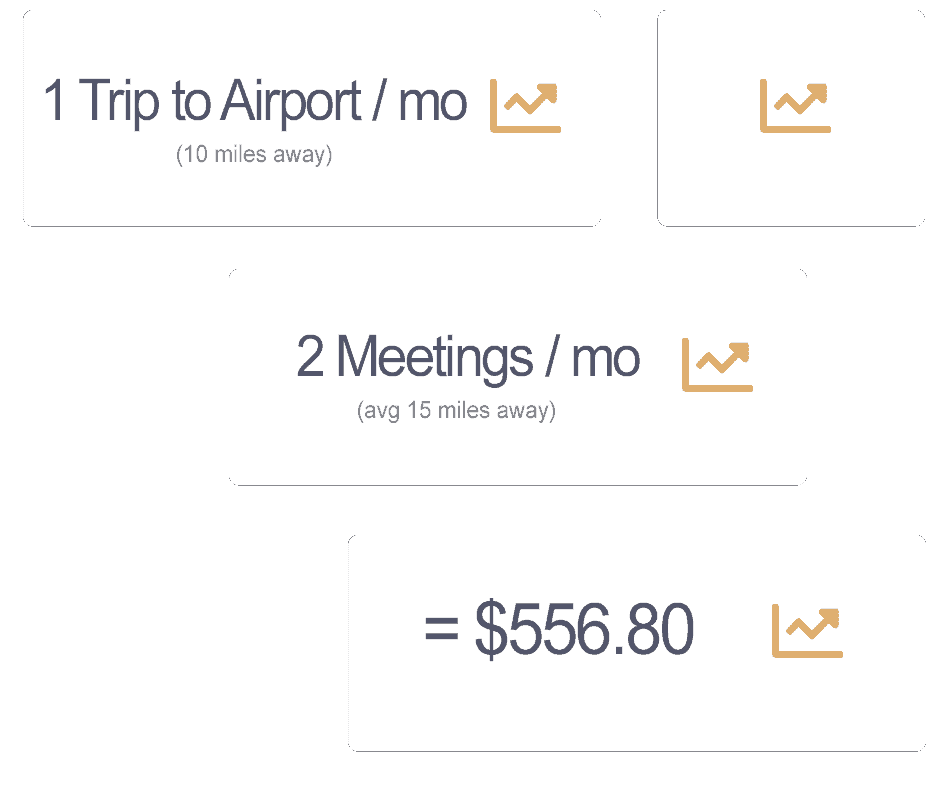

For example…

How Klaimer Works

Instead of tracking every trip after the fact, leverage the info you already have in your calendar. Enter a default starting address, and Klaimer does the rest.

Revolutionary

Approach

By using information you already having in your calendar, you can save yourself a lot of work and anguish.

No more…

How Klaimer Works

Instead of tracking every trip after the fact, leverage the info you already have in your calendar. Enter a default starting address, and Klaimer does the rest.

For example…

Common Uses

Klaimer is for anyone who drives and submits their mileage for either employer reimbursement or for tax deductions. You must have “Locations” set in your calendar entries for mileage calculations.

Expense Reporting

Klaimer quickly and easily generates expense reports weekly, monthly, quarterly, or for any date range…automatically from your calendar entries.

Tax Deductions

Klaimer can help you build your list of tax deductible car mileage expenses for the previous year tax reporting or whenever needed.

Key Features

Klaimer provides all the calendar integration, analysis, and reporting you need to claim all of your expenses for employer reimbursement or tax deductions.

Calendar Integration

Automatic Calculations

Analytics

Categorized Expenses

Trip Editing

Downloadable Reports

Multi-lingual

Projections

Pricing

Choose from monthly or one-time plans.

Pricing

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla vitae lectus a ligula fermentum elementum.

Contact Us

Please feel free to contact use for any reason.

Get notified of our launch

Receive launch updates directly to your inbox.